new mexico gross receipts tax return

Sell property in New Mexico. They offer faster service than transactions via mail or in person.

Looking For A Schedule Ps Private School Tuition Wisconsin Download It For Free

A 2-per-day leased vehicle surcharge is also imposed on certain vehicle leases.

. Gross Receipts by Geographic Area and NAICS Code. Property includes real property tangible personal property including electricity and manufactured homes licenses other than the licenses of copyrights. These amounts may not be the same if you have non-taxable gross receipts - known as deductions.

35 Alternatively the taxpayer may provide a statement affirmatively indicating that the gross receipts tax is included in the amount billed. If you are engaged in business in New Mexico you must file a New Mexico tax return and pay gross receipts tax for the privilege of doing business in New Mexico. These taxes land on businesses and capture business-to-business transactions in addition to final consumer purchases leading to tax pyramiding.

When you file your gross receipts tax report your goal is to know how much tax you have to pay. We urge you to give it a try. The same goes for those who sell research and development services performed outside New Mexico when the resulting product is initially used here.

New Mexico does not have a sales tax like other states we have a Gross Receipts Tax which means businesses pay a tax on their total receipts minus any non-taxable deductions. The tax is imposed on the gross receipts of businesses or people who sell property perform services lease or license property or license a franchise in New Mexico. On April 4 2019 New Mexico Gov.

Gross Receipts by Geographic Area and NAICS Code. Gross Receipts by Geographic Area and 6-digit NAICS Code. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located.

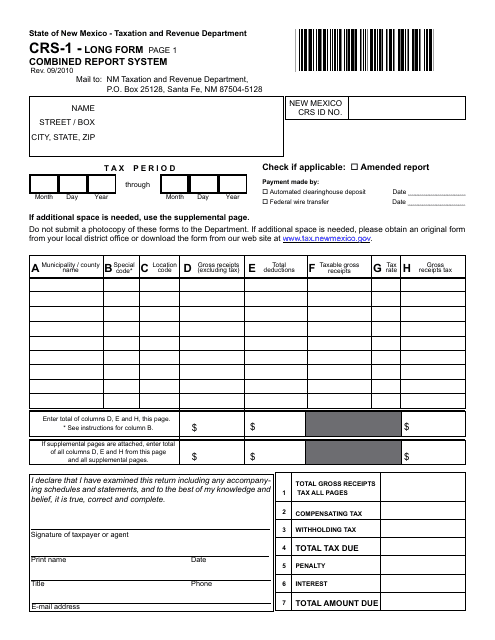

Report the regular gross receipts tax the leased vehicle gross receipts tax and the leased vehicle surcharge on the CRS-1 Form. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. Monthly Local Government Distribution Reports RP-500 Gross Receipts by Location.

When billing a customer for Gross Receipts Tax on or after July 1 2019 New Mexico mandates that taxpayers need to separately state the amount of tax associated with the transaction. Collection and distribution data of the gross receipts tax are also provided in the Monthly Local Government Distribution or RP-500 reports. Each Form TRD-41413 is due on or before the 25th of the month following the end of the tax period being reported.

Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT regimes. The Gross Receipts Tax rate varies throughout the state from 5 to93125. Filing your Gross Receipts Tax GRT online takes the stress out of work so you have time for more enjoyable things.

As for payment E-pay is the quick and green way to. GROSS RECEIPTS TAX RETURN GENERAL INFORMATION This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return. Double-click a form to download it.

Imposition and rate of tax. GRT-PV Gross Receipts Tax Payment Voucher. You must also determine your total gross receipts.

In a nutshell GRT is a substitute for the traditional sales tax that shoppers in other states pay when they make a purchase. The changes to the GRT came primarily in response to the US. Denomination as gross receipts tax.

Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. In New Mexico it is the seller of the goods or services who is responsible for paying the tax due on the transaction.

Seven states currently levy gross receipts taxes while several others including Pennsylvania South Carolina Virginia and West Virginia permit local taxes imposed on a gross receipts base. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. The business pays the total gross receipts tax to the state which then.

The tax imposed by this section shall be referred to as the gross receipts tax. Gross Receipts by Geographic Area and NAICS code. Filing online is fast efficient easy and user friendly.

The business pays the total Gross Receipts Tax to the state which then distributes the counties and municipalities. A gross receipts tax permit can be obtained by registering for a CRS Identification Number online or submitting the paper form ACD-31015. The location code for leased vehicle gross receipts tax is 44-444 and the location code for the leased vehicle surcharge is 44-455.

Information needed to register includes the. After registering the business will be issued a Combined Reporting System CRS Number sometimes known as a New Mexico Tax Identification Number. By Finance New Mexico.

Electronic transactions are safe and secure. Calculation of 112 Increment for the. Supreme Court decision in South Dakota v.

Fiscal Year RP-80 Reports. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. Certain taxpayers are required to file the Form TRD-41413 electronically.

For the privilege of engaging in business an excise tax equal to five and one-eighth percent of gross receipts is imposed on any person engaging in business in New Mexico. First you must determine the amount of taxable gross receipts. New Mexicos gross receipts tax is admittedly confusing but the state still expects businesses to follow the law and pay what they owe from the sale of property or services.

3 21 3 Individual Income Tax Returns Internal Revenue Service

Understanding The 1065 Form Scalefactor

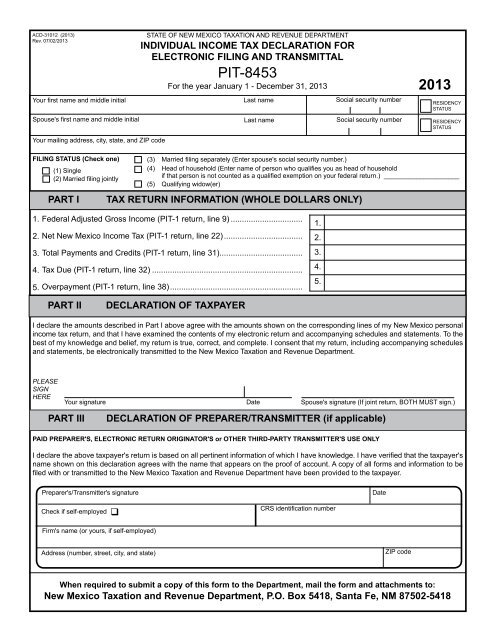

Form Taxation And Revenue Department State Of New Mexico

Taking A Peek At Obama Biden 2014 Tax Returns Don T Mess With Taxes

How To File And Pay Sales Tax In New Mexico Taxvalet

Cancellation Of Homestead Deduction The District Of Columbia Here S A Free Template Create Ready To Use Forms A Deduction District Of Columbia How To Apply

Pin On Global Multi Services Inc

Made A Tax Return Mistake Fix It By X Filing An Amended Return Don T Mess With Taxes

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

How To File Self Employment Taxes Step By Step Your Guide

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

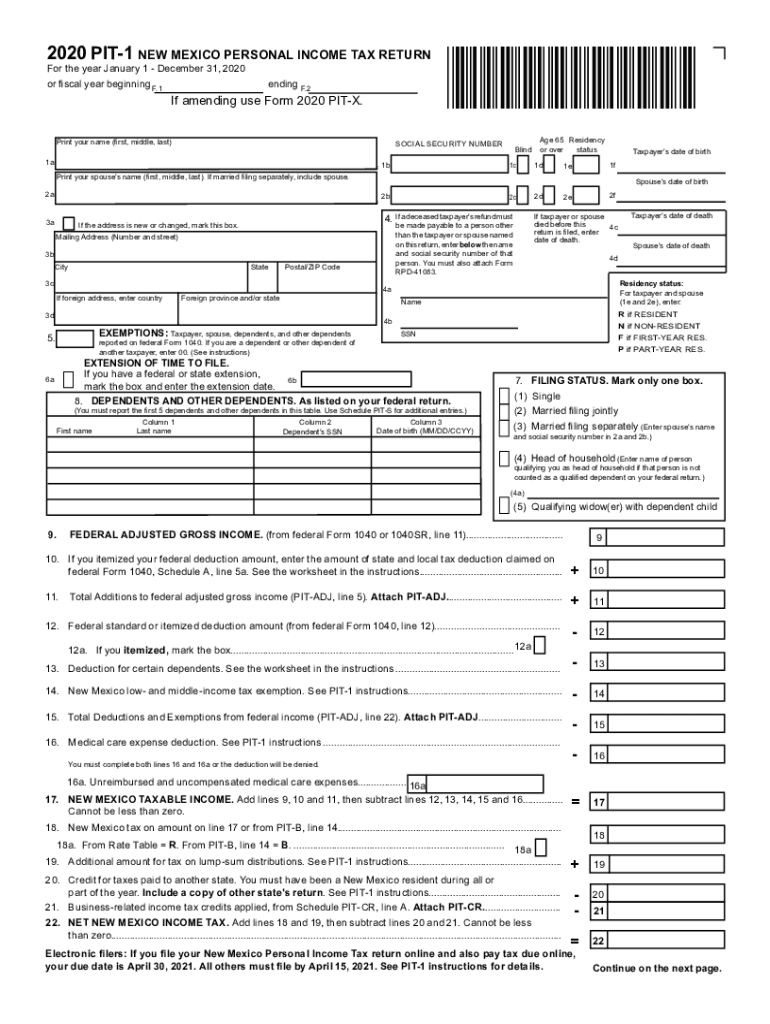

New Mexico Personal Income Tax Spreadsheet Feel Free To Download Income Tax Income Tax

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

3 11 3 Individual Income Tax Returns Internal Revenue Service

What Was Your Adjusted Gross Income For 2019 Federal Student Aid

How To File And Pay Sales Tax In New Mexico Taxvalet

How To File And Pay Sales Tax In New Mexico Taxvalet

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

2020 2022 Form Nm Trd Pit 1 Fill Online Printable Fillable Blank Pdffiller